GoSimpleTax app for iPhone and iPad

Developer: Gosimple Software Limited

First release : 06 Dec 2016

App size: 46.76 Mb

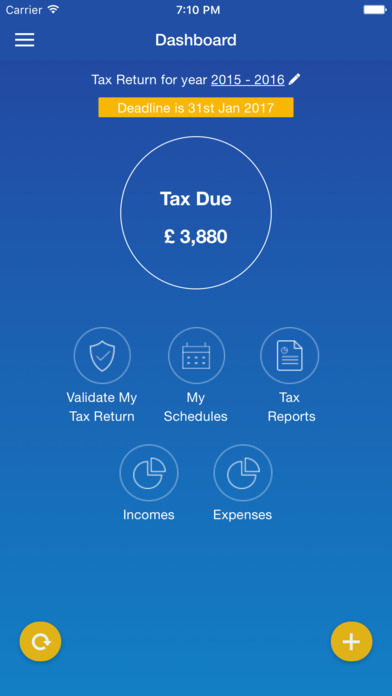

SimpleTax is a HMRC recognised tax calculator that helps you prepare and directly file your self assessment tax return in the easiest and most accurate way possible, especially if youre not an expert. Performing hundreds of double-checks, it points out tax savings that you can qualify for, ensuring you file an accurate self assessment tax return to HMRC really easily from your phone, tablet or web browser.

SimpleTax (https://www.gosimpletax.com) is perfect for sole traders, freelancers, limited company directors, landlords, in fact anyone looking to make a substantial saving on the cost of submitting their self assessment tax return, whilst keeping things simple to understand and use.

As HMRC recognised software, it has met all of the requirements HMRC lays down to ensure a 100% accurate return, based on the information you enter. The developers are backed up by a team with over 25 years’ experience of tax return software, with team members coming from HMRC, accounting practices and the tax software industry. You can be sure that SimpleTax will produce a return to the same quality as an accountant.

Youll also have access to the software on our web site (https://tax.gosimplesoftware.co.uk), allowing you to enter more complex income items such as foreign income, capital gains, Minsters of Religion returns and partnerships.

Whether you need to file a tax return, check if you’re due a rebate or just want to securely store copies of your receipts, SimpleTax is the tax calculator for you. Scanning, tax saving, calculation and filing to HMRC are all included: just pay from £25.00 to make your tax return submission directly to HMRC.

On average that’s a £230 saving on using an accountant.

What’s more, we’re preparing for HMRC’s transformation of the tax system entitled Making Tax Digital that starts in 2018. By using SimpleTax now you’ll see a seamless transition. Get into good habits now with SimpleTax’s simple receipt scanning, so that when MTD becomes a reality in 2020 you are ready and prepared.

As seen in WIRED, Which?, METRO, Mail on Sunday and other major publications, install now and find your tax zen.

Features include:

Submits your Self-Assessment tax return direct to HMRC via a phone, tablet or web site

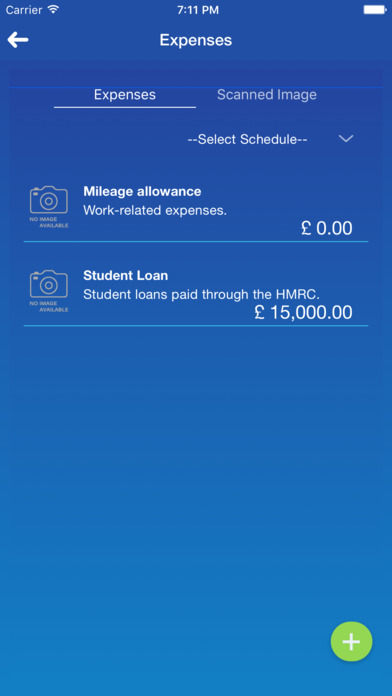

Unlimited scanning of receipts – speeding up the process of adding expenses to your return

Calculations updated in real time – so you can see your tax position quickly and easily

Even if you have more than one job you can add multiple employments (P60 and P11d)

Based on your personal circumstances, SimpleTax suggests ways you can reduce your tax liability

Performs validation checks before submission to HMRC – rest assured your tax return is correct

SimpleTax will send you a copy of your submitted tax return and calculation, which are emailed to you as a PDF

Access your account via our website - add more complex income items such as Partnerships (SA104), Capital Gains (SA108) and Residency (SA109)

Free software support – providing you a helping-hand if you need it

SimpleTax is constantly evolving, in anticipation of Making Tax Digital.

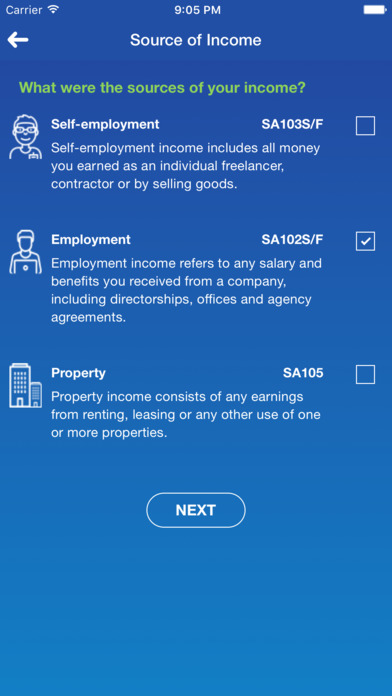

SimpleTax App completes:

SA100 - Basic Information

SA102 - Employment

SA103 – Self employment

SA105 - Property

You can also complete the following schedules on our website:

SA100 – All information including Interest and Dividends and Income from pensions

SA101 – Additional information

SA102 - Employment

SA102M – Ministers of Religion

SA103 - Self-employment Full/Short

SA104 - Partnerships Full/Short

SA106 - Foreign

SA107 - Trusts

SA108 - Capital Gains

SA109 - Residency

SA800 Partnership Tax Returns NOW available via the web app.